In the previous post, we studied the formula for Net Present Value (“NPV”), which answers the question: How much are future payment(s) worth today?

The short answer is: so long as you have positive real interest rates, the value of the future payment is worth less than today.

And if the same dollar in the future is worth less, it is in the best interest of your customers to delay paying you.

Upon Receipt

The simpler the transaction or operation, the simpler the payment terms. Typically, you perform units of work, and when you’re done, you invoice for the time you spent or per milestone, and the customer pays you immediately. No big deal. But these situations are rare when you have large customers with complex Accounts Payables.

[TIP: Know where you are wasting time, cut out the unnecessary busy work, and spend more time on producing milestones—simply with CalendarCrush. Try it free today.]

Net 30

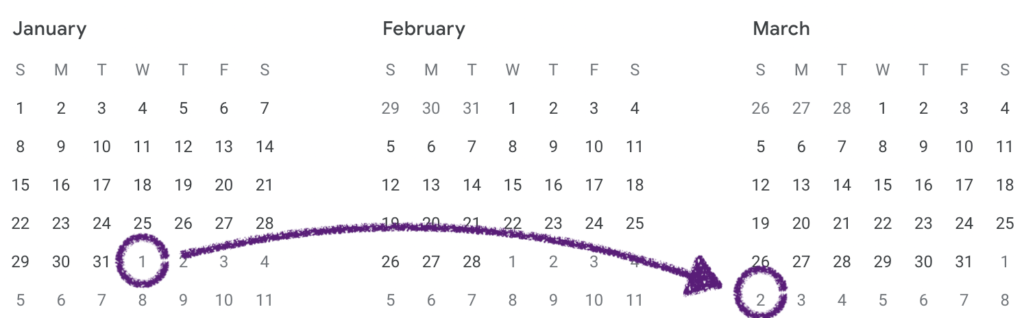

Net 30 payment terms mean that upon receipt of the invoice, the customer has 30-days to pay you. So an example of this would be: You start working for a customer on January 1st. You invoice at the end of the month and send the invoice on February 1st. They have 30 days to pay you: expect payment by March 3rd.

They are paying you on March 3rd for the work you did from Jan 1 to Jan 31. This means there’s a 2-month lag between when the work started and when you get paid. If you’re just starting, you need about two months’ worth of savings to get through this initial period.

The story just gets worse from here

Net 60

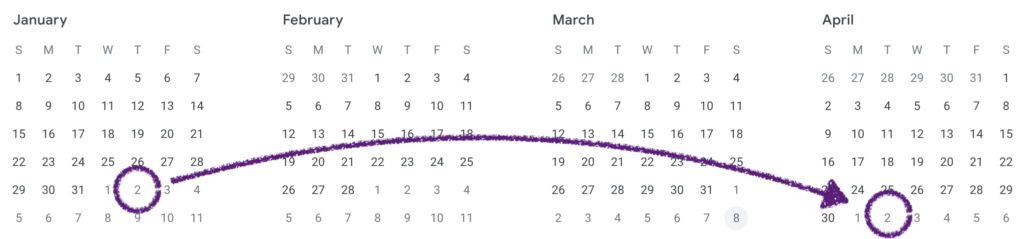

Net 60 means that they have sixty days upon receipt of the invoice to pay you. So if you start work on January 1st and invoice on February 1st, you get paid on April 2nd.

So this isn’t even the same fiscal quarter. If you’re on a cash basis for accounting, you’re booking revenue in Q2 for work that was performed in Q1. Again, if you’re starting out, you need to figure out how to fund yourself for an entire quarter.

Net 90

Net 90 customers are the worst. Some bean counter back there is saying, “Schitt, if 60 is good, 90 is better, right?” And so blatantly are saying, “I will take an entire fiscal quarter to pay you.”

Suffice it to say, if your customers are playing accounting games and you’re not, then you’re going to come out on the losing end. After all, if you have to borrow in order to fund yourself, you’re paying interest.

Resolution

So how do we right this wrong? Answer: You charge more for your services.

How much more? Well, let’s do some math.

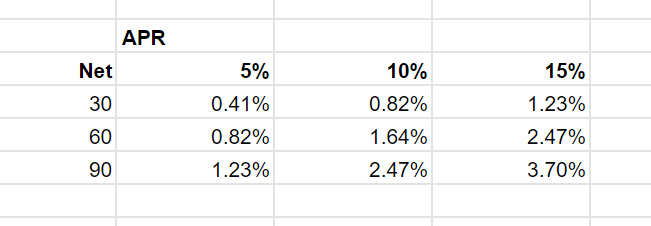

You take the delay in payment in days. Convert it to years (by dividing by 365). Then you multiply by the APR.

So in the example where your cost of borrowing is 5%:

- Net 30 = 30 days * (1 year/ 365 days) * ( 5% / year ) = 0.41%

- Net 60 = 30 days * (1 year/ 365 days) * ( 5% / year ) = 0.82%

- Net 90 = 30 days * (1 year/ 365 days) * ( 5% / year ) = 1.23%

So if we do it for 10% and 15%, this is what it looks like:

So the longer you have to wait for your money and the higher the interest rate, the more you charge. On a $10,000 invoice, you should be charging $41 for a Net30 invoice at 5% APR. On that same amount of a Net90 invoice at 15%, you should be charging $370.

If you’re not raising your rates to accommodate the longer payment terms, this is how much of a discount you’re giving your customers. And believe me, the folks in Accounts Payable (“AP”) have bonus incentives tied to how much they can delay payments.

Want to learn more about the way of the calendar? Try CalendarCrush for free.