Why is the blog about using your calendar talking about the $1,900,000,000 lottery?

Easy. I’ve got some numbers riding on it. Just kidding (I do, but this is a useful post, I promise).

The reason this post is here on a blog concerned with using your calendar (the accounting system of your time) is that we know that time is money. Or rather, money is a way of storing the productive use of your time. You provide a product/service for your fellow human today in exchange for money, which you can spend tomorrow and receive a product/service from your fellow human tomorrow.

Yet, many people don’t understand the relationship between time and money when there are non-zero interest rates. For those under 40, you probably don’t know what these are since we’ve had low-interest rates for as long as you’ve been a working professional.

As of November 7, 2022, the world’s largest-ever jackpot of $1,900,000,000 remains unclaimed.

If you win, you get to have either

- Annuity: $1,900,000,000 over 30-years

- Cash Value or lump sum: $929,100,000 today

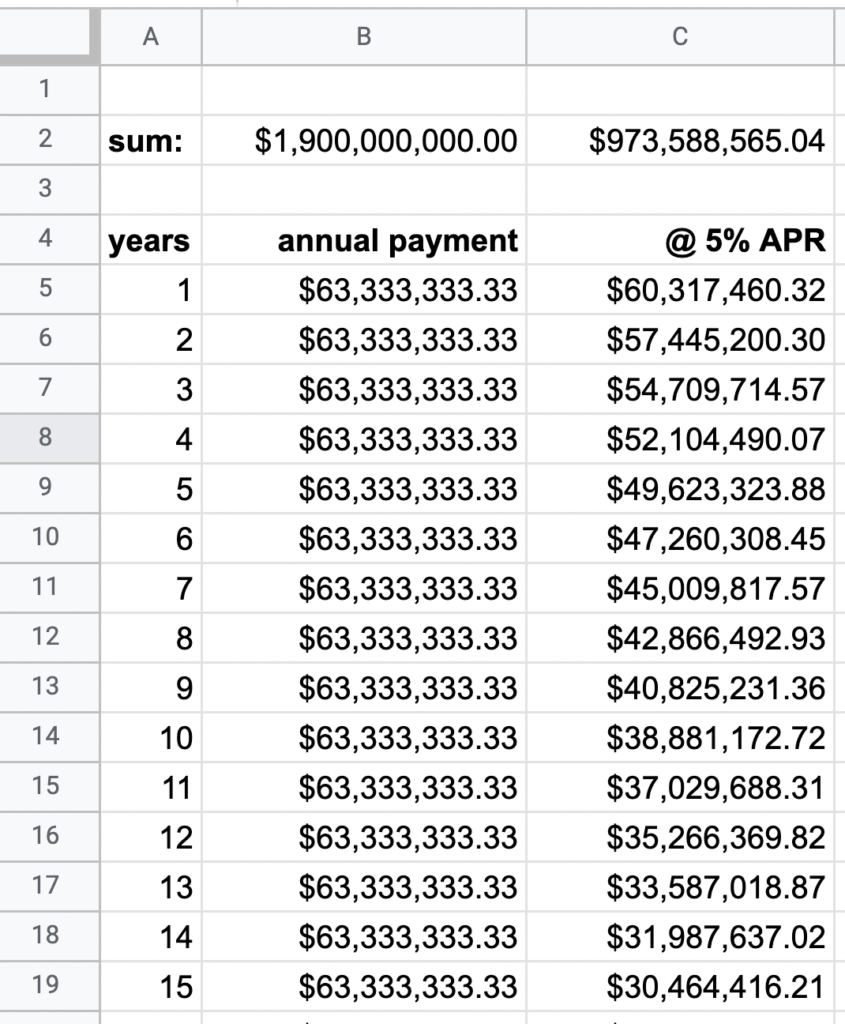

Why is there almost a billion-dollar difference between the annuity and the lump sum? Well, computing the annuity is easy. You take 1.9B and divide that by 30.

You get $63.33 million a year for 30 years. It’s so easy you can do this on your phone.

The lump sum is more involved but not necessarily harder. And the financial term for this is Net Present Value (“NPV”).

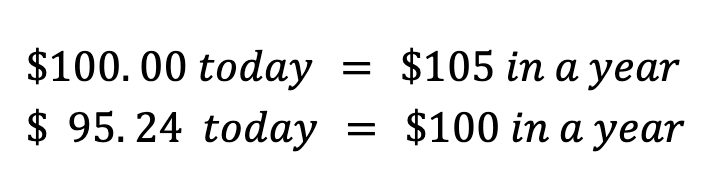

Suppose interest rates are 5%. This says that $100 today equals $105 a year from now. You can ask that question in reverse… if I’m paid $100 in a year, what is that worth to me today?

The answer (for 5% APR) is $95.24 for the first year. Well, how about for year 2? Well, at the end of the first year, I’d be forgoing $105 for another year. At 5% interest, you’d owe me $110.25. So in today’s dollars, that’s $90.70:

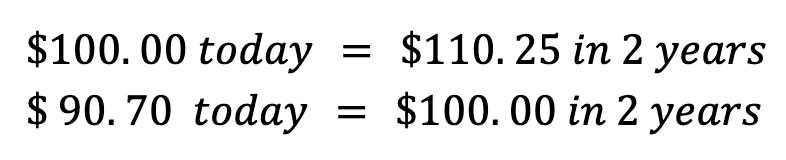

So in this example, a cash flow of $100 per year ($200 total) for 2-years is $185.94 (= 95.24 + 90.70) today. Keep going, and you will see this number decay:

So by the end of 30 years, that $3,000 at 5% constant interest rate is the same as $1,537.25 in today’s dollars.

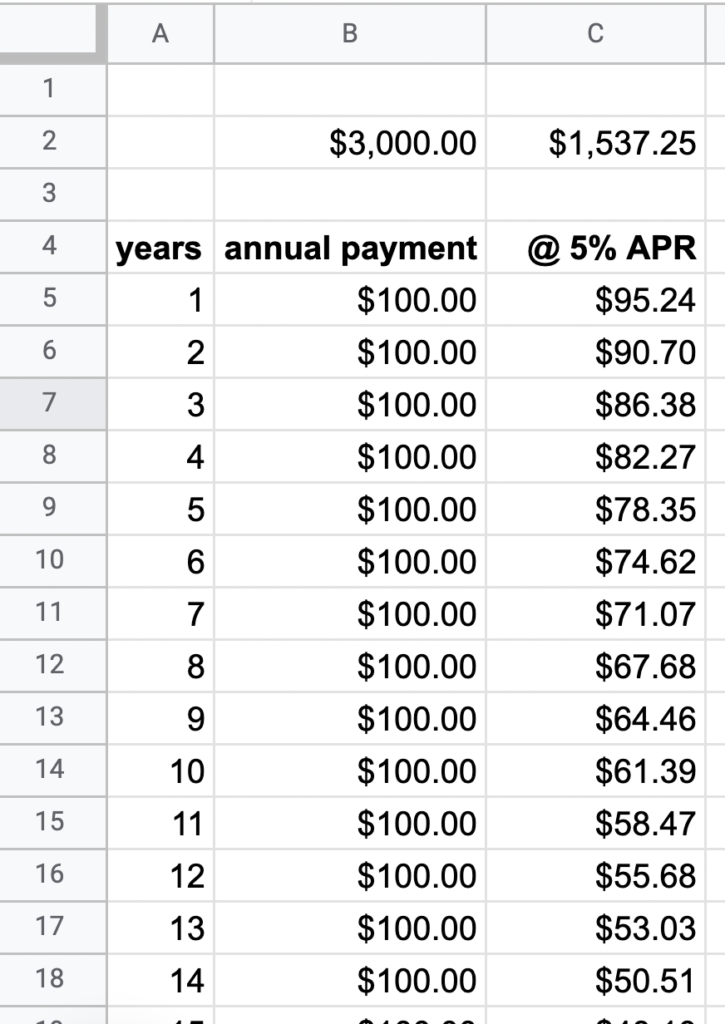

Run these numbers for 1.9B jackpot over 30-years, and you get:

Note the inverse relationship. The higher the interest rate, the lower the lump sum. Since the actual cash value is actually 929.1M per the website, the Powerball lotto officials are imputing an interest rate of approximately 5.41% (and not the 5% we used in our example).

As for whether or not to pick the lump sum over the annuity, this depends on what you think real interest rates are (as well as what real inflation is), among other factors.

But whatever you do, don’t think for a minute that choosing the annuity nets you almost a billion more. It doesn’t. The annuity and lump sum are mathematically equal at the time of choosing.

We don’t know if you are the next lottery winner or not, but we do know how to save you both time and money! Sign up for CalendarCrush today.