Back to work, everyone; I’m blogging and not at the beach, so obviously I didn’t win the jackpot.

Regardless, it was a good opportunity to explain how to think about the bird-in-hand concept (i.e., cash value versus 30 x $63 million birds in the bush). And it all depends on how much people want to be compensated in the future in exchange for their savings today.

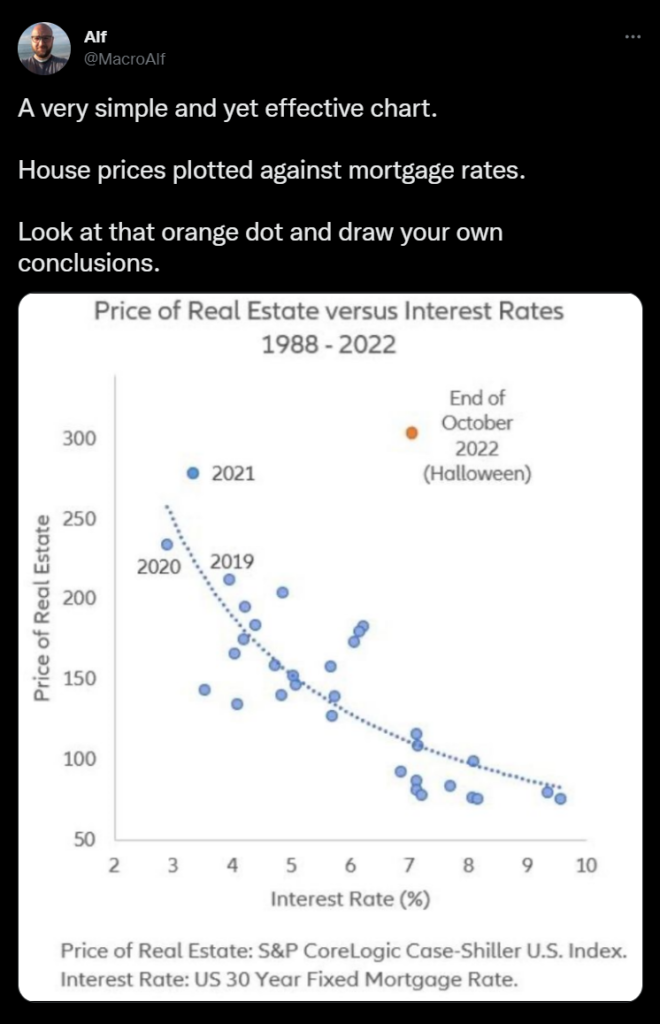

And if you look around, you’ll see this everywhere. I saw this graph on Twitter yesterday.

Now let’s set aside what the “Price of Real Estate” is…. after all, he took an entire year’s worth of Real Estate prices and plotted it as a single dot – so there’s some data reduction going on here. Look at the curvature of the fitted line. (This, by the way, is an engineering trick… ignore the axis and try to understand the relationship.)

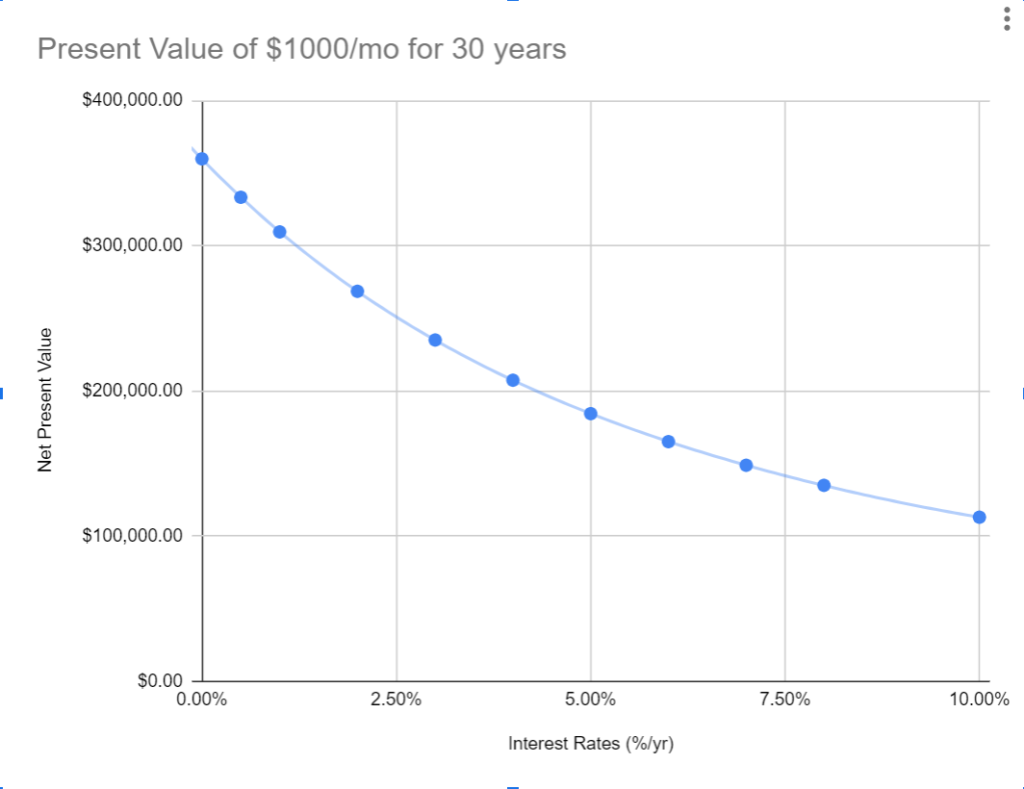

Next, I’m going to show you a plot of Net Present Value of $1,000 per month for 30 years:

Again, notice the shape of this curve. They look the same, but not exactly, right? What this is saying is that the net present value of a cash flow influences (but cannot fully account for all of the variations in) why real estate prices vary with interest rates.

Now, why did I choose a grand a month for 30 years? Well, suppose you’re buying a real estate property… typical loans are 30-year fixed loans. Suppose that after all your expenses, you net $1,000 per month. This graph shows you what the property is worth based on the net operating income. So if you have no idea how to value your real estate business, this is a good place to start. (Aside: there are other factors like population growth, appreciation, etc… which is why NPV cannot be the only main effect in modeling asset values.)

This phenomenon applies everywhere—from lotto tickets… to real estate prices… to the price of stocks in your portfolio. This is why you need to charge higher rates for your business depending on the payment terms you get. And, should you ultimately sell your business, this decides the price you get when you sell (the lower the interest rates, the higher the price fetched).

What is fundamentally happening when you have positive interest rates is that the dollar in your hand has value, and the future dollars you make are worth less. And so you can no longer wait to make money tomorrow. People will make decisions based on this reality.

And since Time is Money, what this is also saying is that the hours you have today are worth more than the hours tomorrow. Your calendar events are worth more today than in the future. Your customers, your competitors, your contractors… will all adjust accordingly. Your mindset should too.

Want to learn more about the way of the calendar? Try CalendarCrush today for free.